The Baltic mergers and acquisitions (M&A) market is in full swing, with companies from the service and retail sector changing hands most actively, according to the recent “Baltic Private M&A Deal Points Study 2020”.

The study was 6th of its kind since 2010, where Sorainen together with other Baltic law firms Cobalt, Ellex, Eversheds Sutherland, TGS Baltic and Walless in cooperation with the Estonian, Latvian and Lithuanian Private Equity and Venture Capital Associations, analysed 122 private M&A transactions completed during the period of January 2018 – March 2020.

IT targets replaced by service firms

Nearly a fifth (18%) of the targets acquired during the study period came from the service sector, followed by retail/wholesale (12%), manufacturing (11%) and construction & real estate (10%) sectors. The picture differs significantly from the last time, when technology (dropping from 17% in 2018 to only 8% in 2020) and energy sectors (13% vs 6%) dominated the scene.

Baltic sellers dominating

Compared to the previous studies, the local Baltic sellers are now clearly dominating, with most active sellers in Estonia and Lithuania. However, the share of pan-Baltic targets has dropped to only 16% in 2020 from 28% two years ago, with a majority of the targets operating in only one Baltic country. Targets outside the Baltics largely come from Sweden, Finland, Poland and Germany.

Exits by strategic investors have somewhat decreased compared to the 2018 study, while the share of private equity and individual exits have increased back to the level of four years ago. Interestingly, the sale of family-controlled businesses keeps growing.

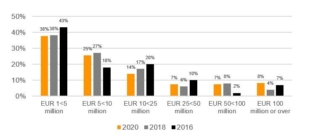

While the value of Baltic M&A transaction typically remains in the EUR 1-10 million bracket, the share of megadeals, valued higher than EUR 100 million, have increased to nearly a tenth of all transactions.

The value of typical Baltic M&A transaction remains below EUR 10 million.

In general, Baltic M&A counterparties are becoming more sophisticated in the use of internationally acknowledged transaction tools, such as price adjustments, MAC clauses, liability limitations (warranty limitation periods, overall caps, claim baskets and thresholds). However, R&W insurance is still very seldom used in Baltic M&A transactions.

Post-covid market insights yet to come

With the survey period ending just at the Covid-19 lockdown, next surveys should disclose whether the pandemic brought any material changes to the market.

Please see the Baltic Private M&A Deal Points Study 2020 here.

You might also be interested in the Baltic Private M&A Deal Points Study 2018.

In case of any further questions, please contact our Corporate and M&A team or the project leader, partner Toomas Prangli directly.