Ober-Haus presents its annual real estate market report for 2024 on the capital cities of the Baltic countries. The report covers the office, retail, warehousing, residential and land markets in each of the capital cities: Riga, Tallinn and Vilnius. Our Baltic-wide team of real estate legal experts prepared legal notes for the report.

Baltic real estate market in 2023: slowdown continues

The year 2023 was full of challenges for the Baltic real estate markets: an economic slowdown, declining activity in the residential and commercial real estate market, a rising number of unsold apartments, higher office vacancy rates and slowing construction volumes.

Activity in the housing market declined for the second consecutive year as potential buyers lost confidence due to worsening economic indicators and the direct impact of high interest rates, which have reduced affordability. Due to the economic and geopolitical situation and record-high interest rates, investors were very cautious in 2023. This caution led to decreased market liquidity and a noticeable yield increase for less desirable properties. Investment deals for commercial property took place at a much slower pace in 2023, as the number of potential buyers reduced significantly.

While the general conditions are similar across the Baltic countries, the overall impact of global factors (the Russia-Ukraine war, high inflation, interest rate hikes) varies.

“Since the real estate market in Latvia and its capital city has lacked fast growth in the last five years, the impact of the current challenges is not as tangible as in other countries. Meanwhile, real estate markets in Estonia and Lithuania experienced an investment boom in the aftermath of Covid-19. Therefore, the slowdown of the last few years has been most felt in both markets, having moved into a much slower phase of development, which is particularly noticeable among market participants who got accustomed to a period of record activity,“ Raimondas Reginis, Head of Market Research for the Baltics at Ober-Haus, said.

Despite this more challenging period, the Baltic real estate markets have managed to avoid a worst-case scenario, which is usually characterised by a substantial decline in rents or sales prices.

“Housing prices demonstrated resilience, with a slight increase recorded in Tallinn and Vilnius in 2023, while Riga experienced only a modest decline. This meant that sellers did not panic and could afford to wait longer for buyers. Strong fundamentals, such as a robust labour market, sufficient savings, and relatively low household debt, prevented a more severe market downturn, like those recently witnessed in some European countries. Although the housing sales market experienced a significant reduction in activity, the rental market remained active in 2023,“ noted CEO of Ober-Haus Real Estate Advisors Tarmo Kase.

2024 outlook: opportunities opening up for investors

The first half of 2024 has not made real estate market participants more optimistic, as the key market indicators remain low.

“Looking ahead to 2024 and beyond, many real estate market participants are pinning their hopes on the European Central Bank’s anticipated interest rate cut. However, we need to understand that any decrease in interest rates will not be rapid, and it will take time for confidence to return and for the real estate market to recover. Additionally, different Baltic countries continue to face various local and global challenges. Despite the predicted economic improvement in Latvia and Lithuania in 2024, Estonia is still struggling to recover, and its real estate market is not exempt from these challenges. This means that the real estate market may offer interesting opportunities for investors in 2024,” commented Tarmo Kase on the market outlook.

Lithuania overview

In 2023, the Lithuanian economy showed remarkable resilience to negative external shocks. Lithuania’s real GDP decreased by 0.3% in 2023 compared to its 1.9% growth in 2022. Essentially, the economic downturn was softened by rapidly increasing public investment volumes and resilient domestic consumption. This was supported by the highest confidence indicators of any European Union country, rapid wage growth, low unemployment levels, and significantly reduced inflation throughout the year. However, the real estate sector experienced another challenging year. Economists predict that decreasing interest rates and increasing real salaries could boost consumption in 2024 and estimate that the Lithuanian economy will grow by around 1.5–2.0% during the year.

Office market

In 2023, Vilnius saw another year of record-breaking levels of completion for new office space. Nine new projects/stages were completed in 2023, bringing 95,500 sqm of office space to the market. Altogether, the total area of usable modern office space (A and B class) grew by over 9% to 1,159,200 sqm. During the period 2019–2023, the Vilnius market added 440,000 sqm of office space, and currently the capital city has 1.92 sqm of useable office space per capita (45% more than five years ago).

Retail market

In 2023, no large traditional shopping centres were opened in Vilnius. At the end of 2023, the 27 shopping centres in the city had a total leasable retail area of 512,700 sqm. Since the city’s population increased by almost 3% in 2023, the shopping area per capita decreased to 0.86 per sqm. Despite the lack of any large traditional shopping centres opening in the capital, investors are still actively seeking opportunities in the retail sector.

Industrial market

Compared to other property sectors, the warehousing sector has been experiencing robust expansion in recent years. This growth has been driven by developing large logistics centres for major retail chains seeking new production and distribution hubs. There has also been a rapid increase in the development of mixed-use stock-office projects; however, less expansion has been observed in the speculative development of traditional warehouses. Five new projects with a total warehousing area of 97,000 sqm were completed in Vilnius and its surroundings during 2023 – 28% more than in 2022. These new projects increased the total leasable area of modern warehouse premises by 12% to 890,100 sqm.

Residential market

For the second consecutive year, the declining activity in the residential property market limited increases in selling price in all residential property segments across all regions of Lithuania. Throughout 2023, there were only small positive – or indeed negative – monthly changes in apartment sale prices, resulting in a minimal price increase for the year. Overall, depending on the city, apartment prices only increased by 1–3% during 2023. The results of the Lithuanian housing market for 2023 and the beginning of 2024 indicate a continued lack of confidence. Regarding land plots, after a 5–10% price increase in Vilnius during 2022, prices remained stable throughout 2023.

> Find out more about the Lithuanian real estate market

Latvia overview

High interest rates made 2023 a struggle. Despite the geopolitical background, inflation in the Eurozone and Latvia is decreasing, but at the same time, it remains above the expected 2% level. It is expected that the 2023 figures will show a decline in GDP of 0.4%, which will be followed by a 2.0% increase in GDP during 2024. However, the Bank of Latvia and other economic experts have highlighted the great uncertainty caused by the global geopolitical situation, the deterioration in consumer confidence, and weak growth across the other Baltic states. In 2025, GDP is expected to increase by 3.6%, and in 2026, by 3.8%.

Office market

In 2023, several A- and B-class office centres were completed in Riga, with a total area of 64,600 sqm. Currently, a total of 730,400 sqm of office space is available for lease in Riga, which is a very large supply of new space. Tenants are in a much stronger position, with more options to choose from. In 2024 and 2025, it is expected that the total supply of office space in Riga will increase by 13%, as developers complete construction of over 100,000 sqm. If this trend continues, Latvia will rival Vilnius and Tallinn with around 850,000 sqm.

Retail market

Last year, the real estate industry was constantly tested for durability. After a number of decisions from the ECB on continuing to raise interest rates, the volume of transactions in the commercial segment decreased, resulting in significantly fewer activities and events across the retail segment throughout the year. By the end of 2023, the total leasable area of shopping centres in Riga was 848,200 sqm. This figure includes traditional shopping centres with a total area of more than 5,000 sqm and at least ten tenants.

Industrial market

During 2023, several new projects with a total warehouse area of around 150,000 sqm were completed in Riga and its surroundings. These new projects increased the total leasable area of modern warehouse premises by 14%, to 1,240,000 sqm. The 2022 trend for renting industrial facilities remained – for tenants, it was more profitable to rent new premises for a higher rate but with lower utility payments than space in old buildings for lower rents but with higher utility payments.

Residential market

Apartment prices in Riga decreased by 1.2% in 2023, after an increase of 4.5% in 2022. The main factor contributing to the overall price reduction was the slight price downturn for typical older apartments in residential districts; for example, prices for apartments in Soviet-era buildings decreased by almost 6%. Meanwhile, prices for apartments in higher-quality buildings and better locations increased slightly during 2023. Compared to the end of 2022, buyer activity has increased slightly but is still moderate. The prices of land plots in 2023 were generally at the same level as in the previous year.

> Find out more about the Latvian real estate market

Estonia overview

2023 was more difficult for the Estonian economy than was expected, and the recession will last longer than was originally predicted. The country’s GDP fell by 3.0%, with another 0.4% decrease expected in 2024. The inflation rate will continue to drop. In 2023, average annual inflation was 9.2% but is expected to decline to 3.4% in 2024, falling to 2.4% in 2025. Construction costs for residential buildings increased by 1.8%, for industrial buildings by 2.4%, and for office buildings by 1.4%.

Office market

Four new office buildings were completed in 2023, bringing nearly 29,000 sqm of office space to the market. With the completion of these projects, the total area of modern office space increased by 2.7% to 1,124,900 sqm by the end of 2023. The completion of several projects was delayed or halted due to the economic recession, high construction costs and reduced demand. In 2023, no new office construction projects were started in Tallinn. International investors were cautious and made no significant investments, while local investors continued looking for suitable sites.

Retail market

In 2023, as in the period 2021–2022, no larger traditional-type shopping centres were opened in Tallinn. At the end of 2023, there were 42 traditional shopping centres with a total leasable area of 678,300 sqm. Based on official population figures, Tallinn currently has 1.47 sqm of shopping centre area per capita, one of Europe’s highest rates. All existing major retailers are planning expansions, but no new major projects are expected in the coming years.

Industrial market

In 2023, 90,000 sqm of new warehouse space was completed in Tallinn and Harju County, providing 1,457,000 sqm of modern warehouse space by the end of that year. Six new stock office projects were completed, bringing almost 41,000 sqm of space to the market, and a further 11 projects totalling 70,000 sqm will be completed during 2024. The greatest demand is for stock office spaces, which include a warehouse, production space, and a representative office for the supply of goods or services.

Residential market

The average price per square metre of an apartment in Tallinn reached new heights, increasing by 3.8% in 2023 to an average price of EUR 3,084 by the end of the year. Compared to previous years, the increase in prices slowed significantly. The number of rent offers increased, and rental prices were under pressure. At the end of the year, the rental stock was about 15% higher than at the end of 2022. The average price per land plot increased by approx. 19% in 2023, and Tallinn’s average residential land price was EUR 290 per sqm.

> Find out more about the Estonian real estate market

About the authors

Ober-Haus provides the full range of real estate services in Lithuania and the Baltic region as a whole. The company opened its first office in Tallinn in 1994. Today, Ober-Haus has 20 representative offices in the major cities of Lithuania, Latvia and Estonia and over 240 employees. The company provides services based on its comprehensive knowledge of local markets and more than 30 years of experience in the real estate sector.

The overview includes information about real estate taxes, which was drawn up by PricewaterhouseCoopers.

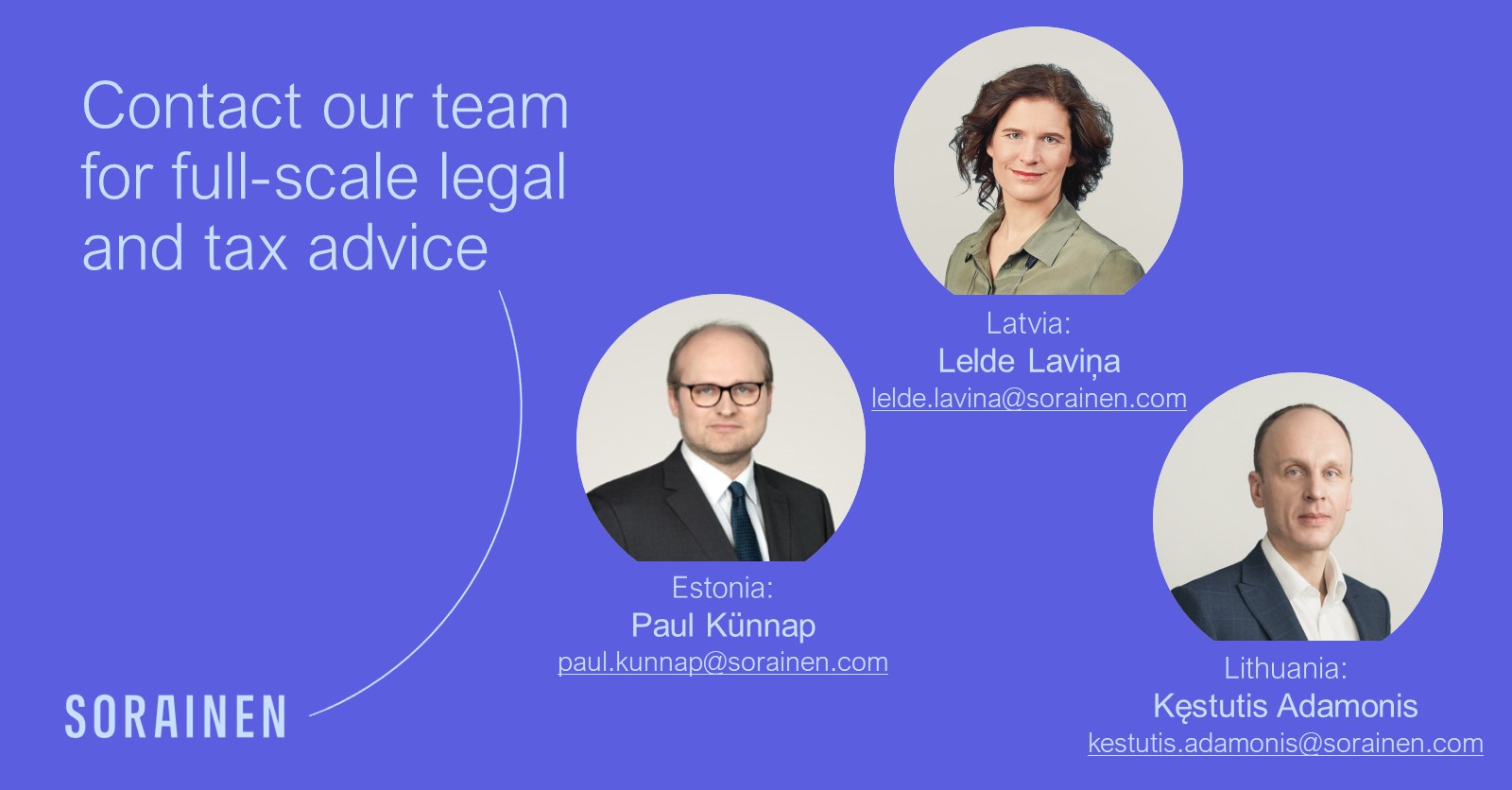

Legal information was prepared by law firm Sorainen. Authors include Andra Grünberg and Paul Künnap in Estonia; Lelde Laviņa, Jorens Jaunozols and Jūlija Triščuka in Latvia; and Kęstutis Adamonis and Simonas Šlitas in Lithuania.